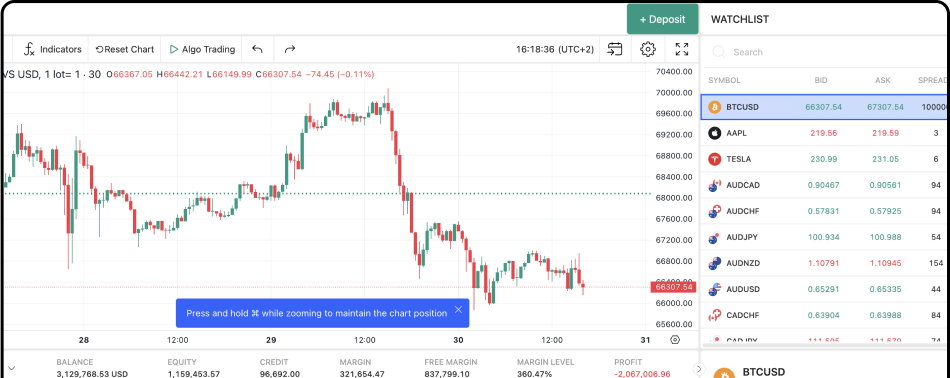

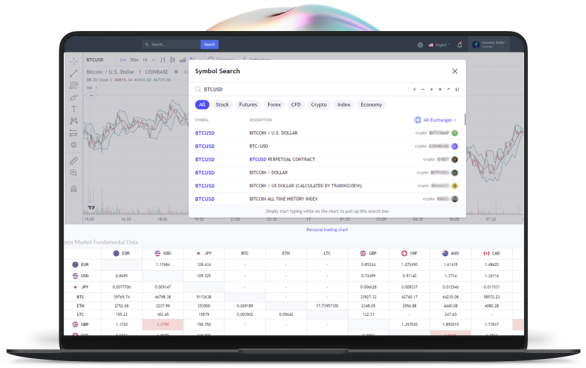

Experiment with your trading strategies across global exchanges.

From the latest market news to real-time expert analyses, you can obtain all you need to trade competitively in one place.

Benefit from the support of a financial advisor

Upifex provides guidance from our financial specialists to help you better understand our products and Services and to explore a world of opportunities in the global trading area.

Trade smarter, faster, and easier, wherever you are.

Discover Upifex, your next-generation mobile trading platform.Enjoy advanced market analyses to anticipate trends.Automation tools to optimize your strategies.

Grab today’s opportunity and Secure your financial Future

Join Upifex